Invalidity Scheme

An Insured Person shall be considered as suffering from invalidity by reason of specific morbid condition of permanent nature either incurable or is not likely to be cured and no longer capable of earning, by work corresponding to his strength and physical ability, at least 1/3 of the customary earnings of a sound Insured Person.

The scheme provides 24-hour coverage to employee who suffers from invalidity or death due to any cause and not related to his employment.

Invalidity Scheme Benefits

Invalidity Pension is:

- Payable to the eligible insured persons who have been certified invalid by the Medical Board or Appellate Medical Board

- Payable from the date Notice of Invalidity is received or from the employee’s resignation date if he / she resigns after the Notice of Invalidity is received by Organisation

- Payable as long as the employee is invalid or until death

- Replaced by Survivors’ Pension if the Invalidity Pension recipient dies, regardless of his / her age

Qualifying Conditions

- Not attained 60 years of age at the time Invalidity Notice is received; or

- In the event that the employee exceeded 60 years of age (with effective from 1 January 2013) at the time the Invalidity Notice is received, he/she must show evidence of:

- Suffering from a specific morbid condition of permanent nature

- Incapable of engaging in any substantially gainful activities

- A morbid condition that has set in before attaining 60 years of age and has not been gainfully employed since then - Certified invalid by the Medical Board or Appellate Medical Board

- Fulfills the qualifying contribution conditions either full or reduced qualifying period

Full Qualifying Period

Insured Persons are deemed to have fulfilled the qualifying period for full contribution if:

- Their monthly contribution has been paid for at least 24 months within a period of 40 consecutive months prior to the month in which their Invalidity Notice is received by PERKESO; or

- Their monthly contribution has been paid for not less than 2/3 of the complete months comprised between the date when contribution first become payable and the Invalidity Notice is received by PERKESO (the total number of monthly contributions that has been paid within that period must be at least 24 months).

Invalidity Pension Rate

The rate of Invalidity Pension for full qualifying period is from 50% to 65% of the average assumed monthly wage subject to a minimum pension of RM550 per month.

The Insured Persons are entitled to receive a pension at the rate of 50% of the average assumed monthly wage, increase by 1% for every 12 months contributions that are paid in excess. However, the rate of monthly pension shall not in any case exceed 65%.

Example of Calculations for Full Qualifying Period:

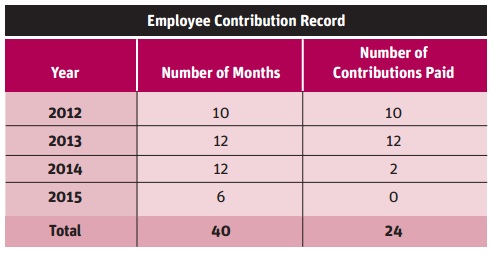

i. Monthly contribution have been paid not less than 24 months within 40 months

- Date of joining the scheme : 01/03/2012

- Date of Notice of Invalidity received : 01/07/2015

- 40 consecutive months preceding the month of Notice received : 03/2012–06/2015

Based on the above example, employees are eligible to receive a pension at a rate of 50% of their average assumed monthly wages.

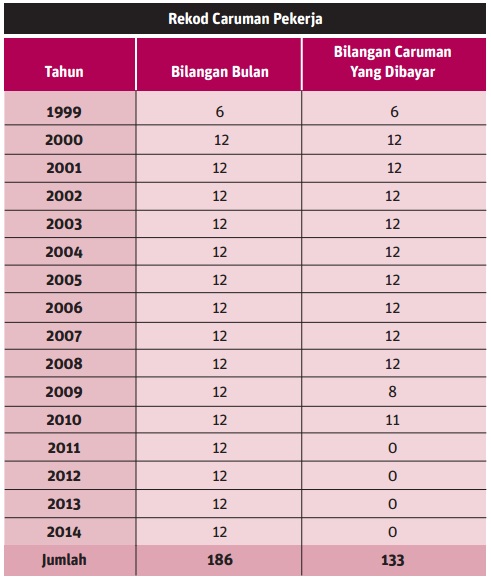

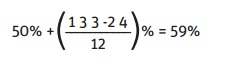

ii. Monthly contribution have been paid not less than 2/3 of the number of complete months when contribution first become payable

i. Date of joining the scheme : 01/07/1999

ii. Date of Notice of Invalidity received : 01/01/2015

iii. Number of monthly contributions for

July 1999 to December 2014 : 186 months

iv. 2/3 monthly contributions paid : 2/3 x 186 months = 124 contributions

- Based on the above example, employees are eligible to receive a pension at the rate of 59% of the average assumed monthly wage based on the following calculation:

Reduced Qualifying Period

The rate of Invalidity Pension for reduced qualifying period is 50% of the average assumed monthly wage subject to a minimum pension of RM550 per month.

Insured Person are deemed to have fulfilled the reduced qualifying period if:- Their monthly contribution has been paid for not less than 1/3 of the complete months comprised between the date when contribution first become payable and the Notice of Invalidity is received by Organisation

- The total number of monthly contributions that has been paid within that period must be at least 24 months

Example of Calculations for Reduced Qualifying Period:

- Monthly contribution have been paid not less than 1/3 of the number of complete months when contribution first become payable

Date of joining the scheme > 01/07/1999

Date of Notice of Invalidity received > 01/01/2015

Number of monthly contribution for

July 1999 to December 2014 > 186 months

1/3 monthly contributions paid > 1/3 x 186 months = 62 contributions

Based on the above example, employees are eligible to receive a pension at the rate of 50% of the average assumed monthly wage.

Invalidity Grant is payable to the eligible Insured Persons who have been certified invalid by the Medical Board or Appellate Medical Board but not eligible for Invalidity Pension due to failure to fulfill any qualifying contribution conditions.

The amount for Invalidity Grant is equivalent to the contributions paid by employee and employer under Invalidity Scheme with interest. It is a one-time lump sum payment.

This allowance is paid to an Insured Person who has been certified and is so severely incapacitated as to constantly require the personal attendance of another person, as recommended by the Medical Board.

This allowance is fixed at RM500 per month.

-

Survivors’ Pension is payable to the eligible dependants of an Insured Person who dies irrespective of the cause of death not related to employment.

Qualifying Conditions- The Insured Person dies before attaining 60 years of age (effective from 1 January 2013) and fulfills the qualifying conditions either full or reduced qualifying period

- The Insured Person who is receiving Invalidity Pension dies regardless of his age

Full Qualifying Period

Insured Person shall be deemed to have completed a full qualifying period if:- Monthly contributions have been paid for at least 24 months within a period of 40 consecutive months preceding the month of his death; or

- Monthly contributions have been paid for not less than 2/3 of the complete months comprised between the date when contribution first become payable and the date of his death provided that the total number of monthly contributions paid shall be at least 24 months

Survivors’ Pension Rate

The rate of Survivors’ Pension for full qualifying period is from 50% to 65% of the average assumed monthly wage subject to a minimum pension of RM550 per month.

The dependants are entitled to receive a pension at the rate of 50% of their average assumed monthly wage, increased by 1% for every 12 months’ contributions that are paid in excess of the first 24 months provided that the rate of monthly pension shall not in any case exceeds 65%.

Note: If the deceased was a recipient of Invalidity Pension, the rate of Survivor’ Pension is equivalent to the rate of Invalidity Pension received by the deceased.

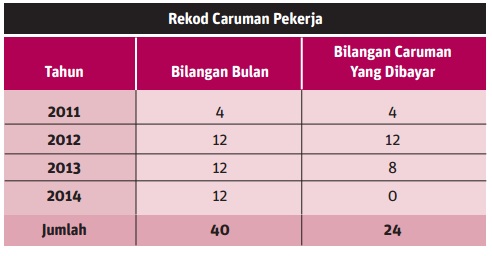

Example of calculations:- Monthly contributions have been paid not less than 24 months within 40 months

Date of joining the scheme > 01/09/2011

Date of death > 01/01/2015

40 consecutive months preceding

the month of death > 09/2011-12/2014

- Dependants are eligible to receive a pension at a rate of 50% of their average assumed monthly wage.

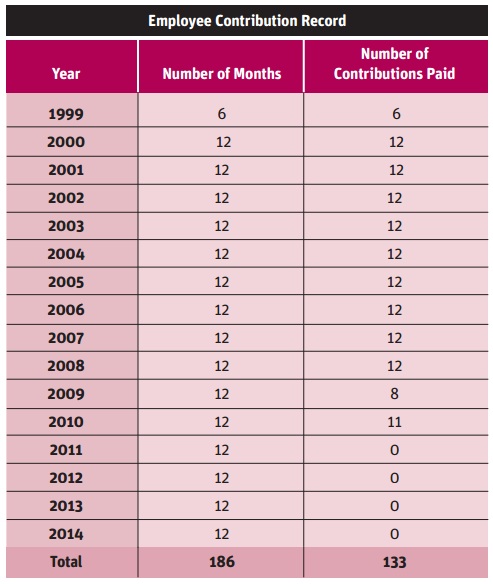

- Monthly contributions have been paid not less than 2/3 of the number of complete months when contributions first become payable

Date of joining the scheme > 01/07/1999

Date of death 01/01/2015

Number of monthly contributions

from July 1999 to December 2014 > 186 months

2/3 monthly contributions paid > 2/3 x 186 months = 124 contributions

- Monthly contributions have been paid not less than 2/3 of the number of complete months when contributions first become payable

Dependants are eligible to receive a pension at the rate of 59% of the average assumed monthly wage based on the following calculation:

-

Reduced Qualifying Period

The rate of Survivors’ Pension for reduced qualifying period is 50% of the average assumed monthly wage subject to a minimum pension of RM475 per month.

Insured Persons are deemed to have fulfilled the reduced qualifying period if:- Their monthly contributions have been paid for not less than 1/3 of the complete months comprised between the date when contribution first become payable and the date of his death.

- The total number of monthly contributions that has been paid within that period must be at least 24 months.

Example of Calculations:- Monthly contributions have been paid not less than 1/3 of the number of complete months when contributions first become payable

Date of joining the scheme > 01/07/1999

Date of joining the scheme > 01/01/2015

Number of monthly contributions

from July 1999 to December 2014 > 186 months

1/3 monthly contributions paid > 1/3 x 186 months = 62 contributions

- Based on the above example, dependants are eligible to receive a pension at the rate of 50% of their average assumed monthly wage.

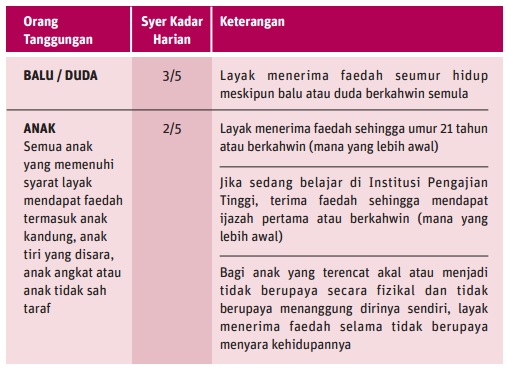

Dependants and Daily Rate

The daily rate of Survivors’ Pension is based on the following priorities:

If an employee dies and does not leave any widow or widower or children, the Survivors’ Pension will be paid to:

Amongst the facilities provided are:

- Physical rehabilitation includes:

Physiotherapy

Occupational therapy

Reconstructive surgery

Supply of prosthetics, orthotics and other appliances

Supply of orthopaedics apparatus such as wheelchair, crutches, hearing aid, spectacles, special shoes and others - Vocational rehabilitation includes:

Training in courses such as electrical, sewing, radio / TV repair, typing and others - Dialysis facilities for Insured Persons suffering from chronic renal failure includes:

Haemodialysis treatment at PERKESO’s panel and non-panel dialysis centre or Government Hospitals

Continuous Ambulatory Peritoneal Dialysis (CAPD)

Subsidy aid for Erythropoietin (EPO) injection

Subsidy aid for Immunosuppressant medicine

Payment for Arteriovenous (AV) Fistula surgery

All expenses incurred for the above rehabilitation facilities will be borne by PERKESO based on stipulated rates, terms and conditions.

Funeral Benefit with amount of RM3,000 (effective from 1 June 2024) will be paid to the eligible person if the employee dies due to any cause. In the absence of such person, the benefit will be paid to the person who actually incurs the expenditure.

The amount paid will be the actual amount incurred or RM3,000 whichever is lower.

This benefit is in the form of loans may be provided to a dependant’s child of an Insured Person who:

- Dies while receiving Invalidity Pension

- Dies before attaining the age of 60 years but has completed a full or a reduced qualifying period

- Is a Invalidity Pension recipient

Note: Application subject to terms and conditions specified by PERKESO.

Service Charge PERKESO Education Loan

Effective 1st January 2013, service charge education loan for all borrowers who received education loan offered before 1st January 2009 has been reduced from 4% to 2%. Meanwhile, for new borrowers who received education loan offered after 1st January 2009, services charged still remain at 2%.

Forms related to benefit claims can be download at the link below :

Menara PERKESO, Jalan Ampang, Kuala Lumpur

This email address is being protected from spambots. You need JavaScript enabled to view it.

1-300-22-8000

Copyright 2023 © Social Security Organisation | All rights reserved