Foreign Workers

Foreign Workers

Foreign workers, including expatriates and foreign domestic workers, are protected under the following schemes :

Employment Injury Scheme

Protection for foreign workers against accident or an occupational disease arising out of and in the course of the employment. The protection under this scheme covers the following:

- Accidents while carrying out work

- Accidents while travelling such as during the route between residence to workplace, route between workplace to place of authorized recess and journey made for any reason which is directly connected to the employment

- Accident during emergency

- Occupational diseases

Effective date: 1 January 2019

Invalidity Scheme

Protection for foreign workers who suffer from invalidity due to a permanent morbid condition which is either incurable or is not likely to be cured resulting to an inability to earn a living, through work corresponding to his strength and physical ability, equivalent to at least 1/3 of the customary earnings of a normal worker. This scheme covers invalidity or death of the foreign worker irrespective of the cause.

Effective date: 1 July 2024

Eligibility Conditions for foreign workers :

- Possess valid passport

- 'Possess valid work pass such as Visit Pass (Temporary Employment), employment pass, special pass and other related work passes.'

Registration and Contribution Payment

Employers are responsible for registering their foreign workers and must ensure that the mandatory contributions are paid in full based on the specified contribution rates. Failure to do so is an offence under Employees’ Social Security Act 1969 (Act 4) and if convicted, can be fined a maximum of RM10,000.00 or 2 years imprisonment or both.

| MANDATORY monthly contribution payment : | Share | Employment Injury Scheme | Invalidity Scheme | Total Contribution |

|---|---|---|---|---|

| Employer | 1.25% | 0.5% | 1.75% | |

| Foreign Worker | - | 0.5% | 0.5% |

Important Note

First Category Contribution (Employment Injury Scheme and Invalidity Scheme)

For foreign workers who first enter or contribute for the first time under the PERKESO Invalidity Scheme under the age of 55 years old.

Second Category Contribution (Employment Injury Scheme)

- For foreign workers who have reached 55 years old or older when they first enter the PERKESO’s Invalidity Scheme; or

- Foreign workers who have reached 60 years old and are still working.

Please visit the following pages to learn more :

Benefits Offered

Employment Injury Scheme

-

Medical Benefit

Employees suffering from employment injuries or occupational diseases may receive free medical treatment at PERKESO’s panel clinic or Government clinic / hospital until they are fully recovered.

Reimbursement

Employers or employees can claim for reimbursement of expenses incurred in respect of medical treatment at PERKESO’s non-panel clinic. Application can be made to PERKESO and the reimbursement is subject to such condition as determined by the Organisation or according to Fees Act 1951. -

Temporary Disablement Benefit

Period of Temporary Disablement

- Temporary Disablement Benefit is paid for the period the employee is on medical leave certified by a doctor for not less than 4 days including the day of accident.

- However, Temporary Disablement Benefit will NOT be paid for the days for which the employee works and earns wages during this period.

Rate of Temporary Disablement Benefit

- The daily rate of Temporary Disablement Benefit is 80% of the employee’s average assumed daily wage. The minimum rate is RM30.00 per day while the maximum rate is RM158.67 per day.

-

Permanent Disablement Benefit

Employees who suffer from permanent disability due to employment injury can apply for this benefit.

Rate of Permanent Disablement Benefit

- The daily rate of Permanent Disablement Benefit is 90% of the employee’s average assumed daily wage, subject to a minimum of RM30.00 per day or a maximum of RM178.50 per day.

Claim Period

- Claim must be made within 12 months from the last date of the temporary disablement.

Assessment and Payment

- Assessment and Payment Claims will be referred to the Medical Board for permanent disability assessment.

- If the assessment does not exceed 20%, payment can be made in the form of lump sum.

- If the assessment exceeds 20%, the employee is given an option to commute 1/5 of daily rate of the benefit into a lump sum payment while the balance will be paid monthly for whole life.

-

Constant Attendance Allowance

This allowance is paid to foreign workers who is suffering from total permanent disablement (100%) and is so severely incapacitated as to constantly require the personal attendance of another person, certified by Medical Board or Special Medical Board or the Appellate Medical Board.

The allowance is fixed at RM500 per month.

-

Physical Rehabilitation Facilities

These facilities are given to eligible employees that includes :

- Physiotherapy

- Reconstructive surgery

- Supply of prosthetics, orthotics and other appliances

- Supply of orthopedics apparatus such as wheelchair, crutches, hearing aid, spectacles, special shoes and others

All expenses incurred for the above rehabilitation facilities will be borne by PERKESO based on stipulated rates, terms and conditions.

-

Dependants' Benefit

If an employee dies as a result of an employment injury, his dependants are entitled to this benefit.

Rate of Daily Benefit To Be Paid

- Daily rate is 90% of the average assumed daily wage subject to a minimum of RM30.00 per day and a maximum of RM178.50 per day.

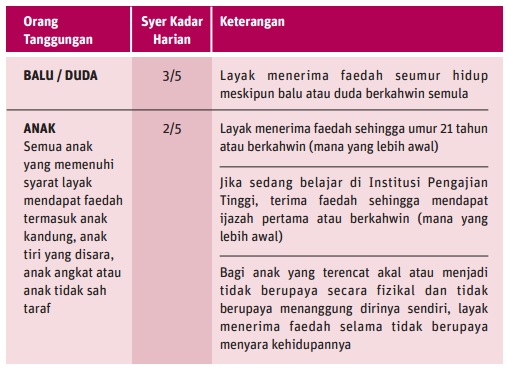

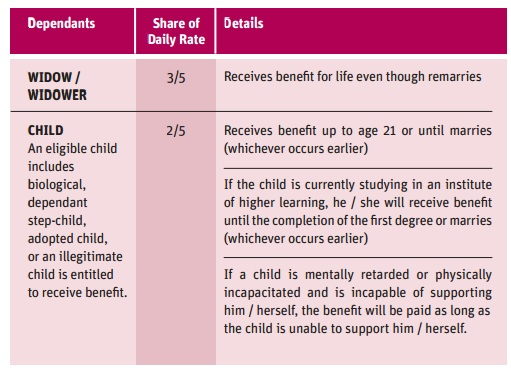

Dependants and Daily Rate Share

i. The daily rate share for for Dependants’ Benefit is based on the following priorities:

Dependants' Share Of Daily Rate Details Widow/widower 3/5 Receives benefit for life even though widow or widower remarries (on or after 1 May 2005)

Child (An eligible child includes biological, dependant step-child, adopted child, or an illegitimate child is entitled to receive benefit)

2/5 Eligible to receives benefit up to age 21 or marriage (whichever occurs earlier)

If the child is currently studying in an institute of higher learning, he/she will receive benefit until the completion of the first degree or marriage (whichever occurs earlier)

If a child is mentally retarded or physically incapacitated and is incapable of supporting him/herself, the benefit will be paid as long as the child is unable to support him/herself

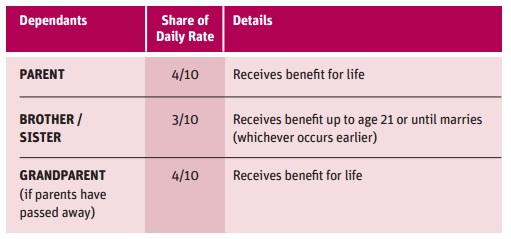

ii. If an employee dies and does not leave any widow or widower or children, the Dependants’ Benefit will be paid to:

Dependants' Share Of Daily Rate Details Parents 4/10 Eligible receives benefit for life Brother/sister

3/10 Eligible receives benefit up to age 21 or marriage (whichever occurs earlier) Grandparents

(If parent passed away)4/10 Receives benefit for life -

Funeral Benefit

Benefit payment will be made to eligible dependants’ or person who bear the funeral costs. The payment amount is the actual amount of expenses or the maximum amount whichever is lower based on the receipt submitted to PERKESO.

The maximum amount of this benefit payment is as below :- If the death occurs in Malaysia and the burial takes place in the country of origin, a maximum cash payment of RM7,500 including the cost of repatriation of the remains/ashes to the country of origin.

Note: Maximum of RM4,500 can be reimbursed to the person who bears the cost of repatriating the remains/ashes while RM3,000 will be paid to the eligible dependants of foreign workers. - If the death and burial only take place in Malaysia, a maximum amount of RM3,000 will be paid.

- For periodic benefit recipients, if death and burial occur in the country of origin, a maximum amount of RM3,000 will be paid.

- If the death occurs in Malaysia and the burial takes place in the country of origin, a maximum cash payment of RM7,500 including the cost of repatriation of the remains/ashes to the country of origin.

Invalidity Scheme

-

Invalidity Pension

What is Invalidity Pension?

- Payable to the eligible foreign workers who have been certified invalid by the Medical Board or Appellate Medical Board.

- Payable from the date Notice of Invalidity is received or from the resignation date if the foreign worker resigns after the Notice of Invalidity is received by PERKESO.

- Payable as long as the employee is suffering from invalid or until death.

- Invalidity occurred while in Malaysia and work pass is valid.

- Replaced with the Survivors’ Pension, if the foreign worker passed away while in receipt of the Invalidity Pension.

Eligibility Conditions

- Not attained 60 years old at the time Notice of Invalidity is received; or

- If the foreign worker exceeded 60 years old (with effective from 1 January 2013) at the time the Invalidity Notice is received, the foreign worker must show evidence of:

I. Suffering from a specific morbid condition of permanent nature.

II. Incapable of engaging in any substantially gainful activities.

III. A morbid condition that has set in before attaining 60 years of age and has not been gainfully employed since then. - Certified invalid by the Medical Board or Appellate Medical Board.

- Fulfils the qualifying period either Full Qualifying Period or Reduced Qualifying Period.

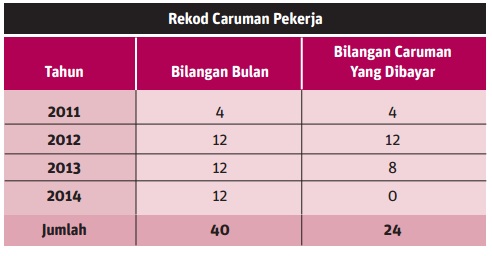

Full Qualifying Period

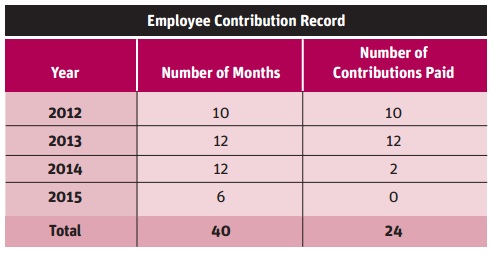

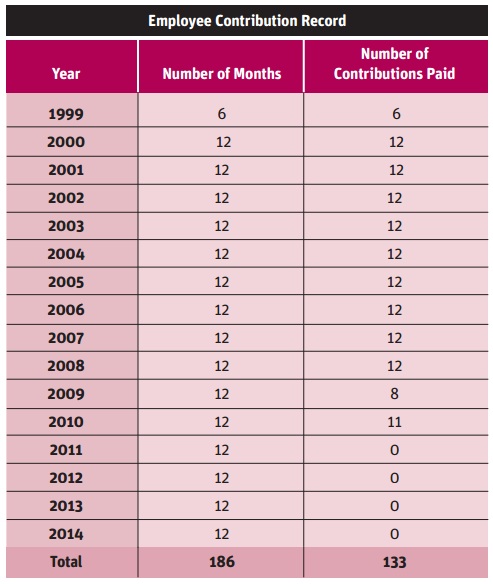

Foreign worker is deemed to have fulfilled the Full Qualifying Period if:- Their monthly contribution has been paid for at least 24 months within a period of 40 consecutive months prior to the month in which their Notice of Invalidity is received by PERKESO; or

- Their monthly contribution has been paid for not less than 2/3 of the complete months comprised between the date when contribution first become payable and the Notice of Invalidity is received by PERKESO.

Invalidity Pension Rate for Full Qualifying Period

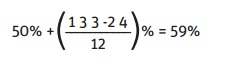

- The rate of Invalidity Pension for full qualifying period is from 50% to 65% of the average assumed monthly wage subject to a minimum pension of RM550 per month.

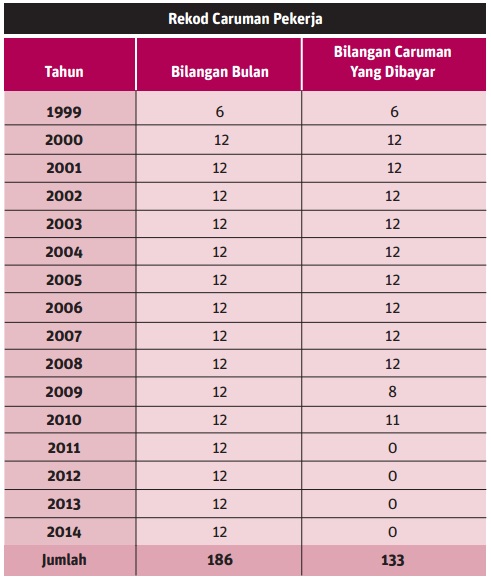

- The foreign worker is eligible to receive a pension at the starting rate of 50% of the average assumed monthly wage, increase by 1% for every 12 remaining monthly contributions. However, it is subject to a maximum pension rate of 65%.

Reduced Qualifying Period

Foreign Workers are deemed to have fulfilled the reduced qualifying period if:- Their monthly contribution has been paid for not less than 1/3 of the complete months comprised between the date when contribution first become payable and the Notice of Invalidity is received by PERKESO.

- The total number of monthly contributions that has been paid within that period must be at least 24 months.

Invalidity Pension Rate for Reduced Qualifying Period

- The rate of Invalidity Pension for reduced qualifying period is 50% of the average assumed monthly wage subject to a minimum pension of RM550 per month.

*Qualifying contribution condition refers to the monthly contribution paid under the PERKESO Invalidity Scheme.

-

Invalidity Grant

What is Invalidity Grant?

Invalidity Grant is payable to foreign workers who have been certified invalid by the Medical Board or Appellate Medical Board but are not eligible for Invalidity Pension due to failure to fulfil any of the qualifying period.

The amount for Invalidity Grant is equivalent to the contributions paid by foreign worker and employer under Invalidity Scheme with interest. It is a one-time lump sum payment. -

Constant-Attendance Allowance

What is Constant-Attendance Allowance?

This allowance is paid to a foreign worker who is suffering from invalidity and is so severely incapacitated as to constantly require the personal attendance of another person as certified by Medical Board or the Appellate Medical Board.

The allowance is fixed at RM500 per month. -

Physical Rehabilitation Facilities

What is Physical Rehabilitation Facilities?

Physical rehabilitation facilities except vocational rehabilitation/ dialysis treatment/ Return To Work

Examples of physical rehabilitation facilities provided are as follows:

- Physiotherapy

- Occupational therapy

- Reconstructive surgery

- Supply of prosthetics, orthotics and other appliances

- Supply of orthopaedics apparatus such as wheelchair, crutches, hearing aid, spectacles, special shoes and others

All expenses incurred for the above rehabilitation facilities will be borne by PERKESO based on the stipulated rates and terms and conditions.

-

Survivor’s Pension

What is Survivor’s Pension?

Survivors’ Pension is payable to the eligible dependants of a foreign worker who dies irrespective of the cause of death.

Eligibility Conditions

- The foreign worker dies before attaining 60 years old in Malaysia and fulfils the qualifying conditions either Full Qualifying Period or Reduced Qualifying Period; or

- The foreign worker who is currently an Invalidity Pension recipient dies.

Full Qualifying Period

Foreign worker is deemed to have fulfilled the full qualifying period if:

- Their monthly contribution has been paid for at least 24 months within a period of 40 consecutive months prior to the month in which their Notice of Invalidity is received by PERKESO; or

- Their monthly contribution has been paid for not less than 2/3 of the complete months comprised between the date when contribution first become payable under the Act and the date of death.

Survivor’s Pension Rate for Full Qualifying Period

- The rate of Survivors’ Pension for full qualifying period is from 50% to 65% of the average assumed monthly wage subject to a minimum pension of RM550 per month.

- The dependants are eligible to receive a pension at the rate of 50% of their average assumed monthly wage, increased by 1% for every 12 remaining monthly contributions. However, it is subject to a maximum pension rate of 65%.

Note: If the deceased foreign worker is an Invalidity Pension recipient, the full rate of Survivor’s Pension is equivalent to the rate of Invalidity Pension previously received by the deceased.

Reduced Qualifying Period

Foreign Worker is deemed to have fulfilled the reduced qualifying period if:- Their monthly contribution has been paid for not less than 1/3 of the complete months comprised between the date when contribution first become payable and date of death.

- The total number of monthly contributions that has been paid within that period must be at least 24 months.

Survivor’s Pension Rate for Reduced Qualifying Period.

- The rate of Invalidity Pension for reduced qualifying period is 50% of the average assumed monthly wage subject to a minimum pension of RM550 per month.

Dependants and Daily Share Rate

The daily rate of Survivors’ Pension is based on the following priorities:

If there is no widow/widower or children, the Survivors’ Pension will be paid to :

*Qualifying contribution condition refers to the monthly contribution paid under the PERKESO Invalidity Scheme. -

Funeral Benefit

Benefit payment will be made to eligible dependants’ or person who bear the funeral costs. The payment amount is the actual amount of expenses or the maximum amount whichever is lower based on the receipt submitted to PERKESO.

The maximum amount of this benefit payment is as below :- If the death occurs in Malaysia and the burial takes place in the country of origin, a maximum cash payment of RM7,500 including the cost of the repatriation of the remains/ashes to the country of origin.

Note: Only a maximum of RM4,500 can be reimbursed to the person who bears the cost of repatriating the remains/ashes while RM3,000 will be paid to the eligible dependants of foreign workers. - If the death and burial only take place in Malaysia, a maximum amount of RM3,000 will be paid.

- For Invalidity Pension recipients, if death and burial occur in the country of origin, a maximum amount of RM3,000 will be paid.

- If the death occurs in Malaysia and the burial takes place in the country of origin, a maximum cash payment of RM7,500 including the cost of the repatriation of the remains/ashes to the country of origin.

Additional Initiative: Funeral Repatriation Cost

-

1. Funeral Repatriation Cost

Other than the benefits mentioned above, PERKESO provides an additional initiative for when a foreign worker dies in Malaysia due to circumstances which does not fall under the coverage of any of the social security protection schemes for foreign workers.

The cost of repatriation of the foreign worker’s remains/ashes to the home country may be reimbursed by PERKESO maximum RM4,500.00 based on the receipt (subject to current policies).

-

2. ACare Simcard Plan

The ACare Sim Card Plan is a product under the PERKESO Rehabilitation Centre that provides mobile prepaid service for foreign workers. This plan also offers a FREE repatriation to the home country specifically for foreign worker subscribers who are confirmed ‘unfit to work’ subject to the specified terms and conditions. Get more information by visiting the website:

Related Info

- Rate of Contribution

- Benefit Application

- Clarification On Coverage

- Directive & Circulars

- FAQ - Extension of the Invalidity Scheme

Download Flyers

Federal Government Gazette

Employees' Social Security (Exemption of Foreign Workers) (Revocation) Notification 2018

Employees' Social Security (Exemption) (No.2) Notification 2018

Employees' Social Security (Exemption) Notification (2018)

Employees' Social Security (Exemption) Notification (2018)

Perintah Keselamatan Sosial Pekerja - Pindaan Jadual Pertama (2024)

Peraturan-Peraturan Sosial Pekerja (Amaun Faedah Pengurusan Mayat) (Pindaan)(No.2)2024

Pemberitahuan Keselamatan Sosial Pekerja(Pengecualian Faedah Bagi Pekerja Asing)2024

- Hits: 279899